Tax From Your Couch

The Process

First, get in touch. Email us when you are ready to begin, (or if you have received an email to us, click the link when prompted).

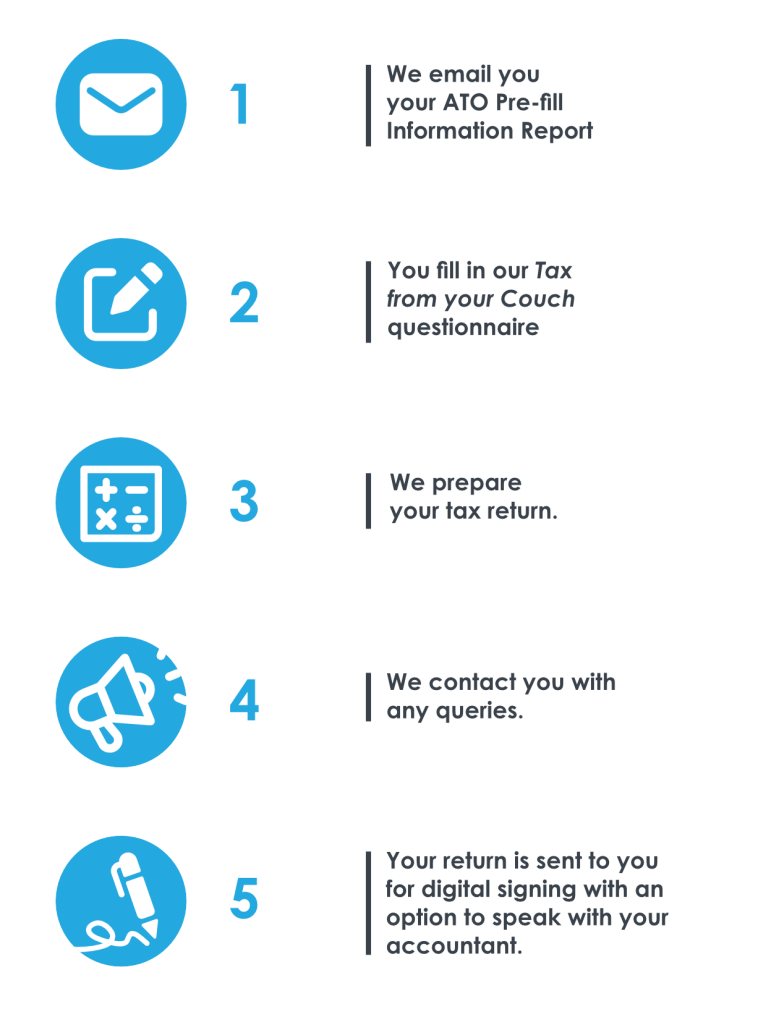

1. We e-mail you your ATO Pre-fill Information Report

Within 1 business days of hearing from you.

This will contain all the information that the ATO has on file for you (income Statement from employer, bank interest, share dividends, health insurance etc.)

You can confirm or update if anything is missing in step 2.

2. You fill in our Tax From Your Couch questionnaire

15 minutes if you have your information ready.

This will ask you questions to provide us with any additional income and prompt you with possible deductions you can claim. We recommend summarising all of your deductions, prior to beginning the process. This process should take about 10 minutes.

If you already have a spreadsheet or your deductions summarised separately, you’ll be able to upload this through our secure Tax From Your Couch System. (Sample spreadsheets for rentals, and non-GST registered businesses are below)

3. We prepare your tax return

We aim to get this complete within 2 weeks however this may blow out during peak time.

Using your data from your pre-fill and what we have collected through Tax From Your Couch, we will prepare your return. We will work out what you can claim and the most beneficial way of doing so.

If we have any queries or need to clarify anything, an accountant will reach out to you via email.

If you have any additions or queries, please send these to our assist email rather than sending to your Accountant directly, this will ensure everything hits your file and documents are not missed.

4. We contact you with any queries

If we identity any issues or missing information in what you’ve provided us, we’ll contact you to clarify them.

5. The tax return is then emailed to you for review and electronic signing

5 minutes

If you have any queries once you have reviewed your tax return, we will schedule a phone or Zoom call with one of our accountants for a chat prior to lodgement.

If you have any other general questions, these can be asked during this chat.

Pricing

| Service | Pricing(from) |

|---|---|

| Base individual | $220 |

| Rental property schedule** | $150+ |

| Rental short stay schedule** (i.e. Airbnb) | $280+ |

| Managed Fund/non-prefilled dividends | $50+ |

| Capital gains calculations (typical) | $150 – $350+ |

| Small business schedule | $200+ |

| Foreign investment schedule | $80+ |

| Cryptocurrency disposals | POA |

| Advice consultations throughout the year | $150 – $300 p/h (varies by accountant) |

* Pricing is for preparation based on your initial information provided as well as reasonable and timely responses to queries. Excessive back and forth, advice consultations and changes after final returns are sent for signing will incur additional fees.

** Note rental schedule fees are charged once per property,

(i.e. if you hold a property with a partner, you won’t be charged for the property twice)

Prices above are current as at July 2024.

Resources

To start gathering everything together, here are some handy links that may help:

(best to view on desktop)

- Deductions checklist

A list of common Income declared as well as deductions. - Rental Schedule

An excel spreadsheet to help gather your rental property details - Rental Schedule (shortstay tenants)

An excel spreadsheet to help gather your rental property details for short stay tenants - Sole Trader – Small Business Schedule (Under $75k)

If you’re not on Xero and don’t have your own spreadsheet, this is an excel spreadsheet to help gather your small business/sole trader business (not registered for GST) details throughout the year.