Posts

Small land subdivision makes for big tax costs

You’ve got a block of land that’s perfect for a subdivision. The details have all been worked out with Council, the builders, and the bank. But, one important aspect has been left out; the tax implications.

Many small-scale developers…

Investment Property Advice

Shaun recently was a guest speaker in an investment property live event with Wheatley Finance, called 'Good Debt, Bad Debt'.

The full recording (a whopping 2 hours of content) hasn't been released yet, but we will link to it when it becomes…

Selling an investment property?

When you sell an investment property, you may make either a capital gain or a capital loss.

A capital gain or loss is the difference between what it cost you to obtain and improve the property (the cost base) and the amount you receive when…

Tips for buying your first investment property

There are many people who believe that when it comes to investing, nothing beats real estate.

This may be true, but you still have to be smart when making your real estate investment decisions. Although investment properties can be a…

Your SMSF: when expenses and investments are not at arm’s-length

We often get questions from clients about what they can and cannot do in their SMSF.

Often the questions relate to related party transactions – that is, interactions between the SMSF, its assets, and its members (or relatives of members).…

Understanding CGT when you inherit

Receiving an inheritance is always welcome, but people often forget the tax man will take a keen interest in their good fortune.

When ownership of an asset is transferred, it triggers a capital gain or loss with potential tax implications.…

Guest post: Depreciation on investment properties

We have a guest post from our friends over at Capital Claims Tax Depreciation.

How claiming for depreciation boosts cash flow

Right now cash flow is front of mind for so many landlords. With the economy hurting, maximising cash flow from…

The ins and outs of SMSF property investing

With a property market recovery underway, most notably in Sydney and Melbourne, Australian investors are once again pursuing their love affair with property investing.

For many investors, a popular way to invest directly in residential…

Vacant land deduction changes

Legislation that passed through Parliament last month prevents taxpayers from claiming a deduction for expenses incurred for holding vacant land.

The amendments are not only retrospective but go beyond purely vacant land.

Previously,…

Positives and negatives of gearing

Negatively gearing an investment property is viewed by many Australians as a tax effective way to get ahead.

According to Treasury, more than 1.9 million people earned rental income in 2012-13 and of those about 1.3 million reported a…

Rental property expenses: what you can and can’t claim

It’s not uncommon for landlords to be confused about what they can and can’t claim for their rental properties.

In general, deductions can only be claimed if they were incurred in the period that you rented the property or during…

Own an investment property?

Get ready for tax time

Tax time has arrived, and we have put together some practical information to help rental property owners prepare and lodge your tax return this year.

There are helpful resources available for rental property…

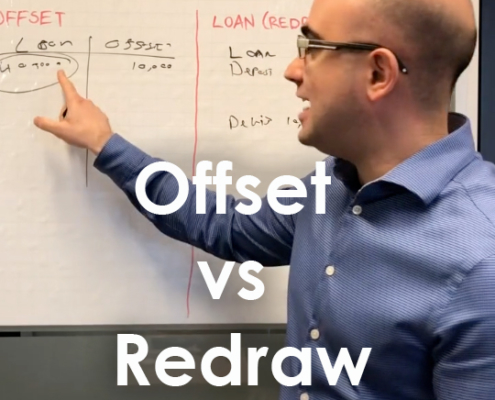

Offset vs Redraw

Shaun Farrugia recently created this video to explain a question that was on a few of our clients lips.

Watch below to hear the difference between an offset and a redraw account on your home loan. This is a question we do get very often,…

What you need to know before buying your second property

Whether it’s as an investment asset or a holiday home, buying your second property poses a unique set of challenges. Here’s what you should consider.

Australians love property, and it’s not difficult to see why. Property is seen…

Going guarantor on a family member’s loan?

Saying no to family is always difficult. But if a family member or friend asks you to become a loan guarantor, it always pays to think carefully before signing on the dotted line.

Being a co-borrower or guarantor on a loan certainly has…

Lending restrictions could soon ease

Financing options for homebuyers could open up once more with the federal government suggesting that lending restrictions could be eased if property prices fall sharper than expected.

Federal Treasurer Scott Morrison says the government…

Why it might be time to consider a principal-and-interest home loan

Australians have gravitated towards the benefits of interest-only home loans in high numbers in years gone by. But a raft of changes mean it might be a good time to start looking into the principal-and-interest option instead.

In Australia, four…

Regulator to crack down on home loan lending standards

It could soon become harder for Aussie families to secure a loan directly from lenders, with the prudential regulator warning people to prepare for a crackdown on lending standards.

APRA’s main concern is that banks and other lenders…

Individual Tax Deductions Checklist

Can you believe it's tax time again already?

As we aren't holding in person tax return appointments this year, all information will be collected using our Tax From Your Couch.

If you'd like to gather your information in a spreadsheet prior…