Business and Tax articles

If you have anything specific you would like us to write about, please let us know.

Categories:

Business

Business

Tax

Tax

Due dates

Due dates

Covid-19

Covid-19

Business exiting

Business exiting

New business

New business

News

News

Superannuation

Superannuation

Personal Finance & Crypto

Planning & growth

Planning and Growth

Business structuring

Business structuring

Lifestyle

Lifestyle

New clients

New clients

Technology & Xero

Technology & Xero

Optimised news

Optimised news

Our latest articles:

Turning Ambitions into Action: A Goal-Setting Blueprint for Small Business Owners

Goal Setting for the New Year

Every new year, I find myself doing two things: taking stock of what I’ve learned over the past twelve months, and dreaming about what I want to make happen next. As a business owner, I know goals aren’t…

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

0

0

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-15 12:40:032024-05-21 13:54:41Budget 2024 – Wrap Up Video

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

0

0

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-15 12:40:032024-05-21 13:54:41Budget 2024 – Wrap Up Video https://www.optimisedaccounting.com.au/wp-content/uploads/2024/05/ThumbBudget24-1.webp

1193

1207

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-09 17:22:392024-05-20 12:54:22Budget 2024 live wrap-up and what to do before June 30!

https://www.optimisedaccounting.com.au/wp-content/uploads/2024/05/ThumbBudget24-1.webp

1193

1207

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-09 17:22:392024-05-20 12:54:22Budget 2024 live wrap-up and what to do before June 30!

Your company isn’t a bank account: loan to a business right

You're finally your own boss, and in its early days, the business needs upstart funds. Such as a loan to a business, to sustain it until it finds its own feet. But you can't move funding sources in and out like in a bank account, and the ATO…

Can the ATO make a tax debt invisible to you?

For both individuals and small business owners, the idea of tax debt with unseen consequences is worrisome. It can impact future financial operations without clear signals or the usual pathways to address it.

Usually when you owe a tax debt,…

2025 FBT Update & EV concession changes that may affect you

As the Fringe Benefits Tax (FBT) year concludes on March 31, 2025, it's crucial for employers to stay informed about the latest updates, particularly concerning electric vehicles (EVs). The Australian Taxation Office (ATO) has introduced…

Swerve out of car FBT record keeping roadblocks

31st of March every year marks the time to read the car odometer; not for the next visit to the mechanic, but for car FBT (Fringe Benefits Tax) reporting on your business' vehicles.

You’re providing a car and it’s your obligation to report…

Last minute Stage 3 Tax Cuts redesigned

Finally bringing down the knife: the Federal Government released a proposal to realign and redistribute personal income tax cuts legislation, to commence on 1 July 2024, for the 2025 financial return year.

[Edit 14th March 2024]: on the…

Can my SMSF invest in property development?

Australians love property. The lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is enticing for SMSF trustees. It encourages them to pursue the dream of large returns…

Guilty as Charged: when your evidence doesn’t match what you tell the ATO

In the world of tax, good intentions only go so far. A recent case involving subdivided farmland before the Administrative Appeals Tribunal (AAT) reinforces that evidence must support the tax position you are taking.

The case involves…

House flipping tax incoming: a taxpayer claims a loss on her home

Flipping houses is a popular way, thanks to TV shows, for Australians looking for a profit renovating a property in order to sell it in the short term. But the reality is less glamorous: taxpayers may soon have to pay a house flipping tax…

A summary of all business tax changes this year

Employers & business

Superannuation guarantee increases to 11% from 10.5%

National and Award minimum wage increases take effect.

The minimum salary that must be paid to a sponsored employee - the Temporary Skilled Migration…

The Billion Dollar TikTok Scandal

$1.7 billion paid out in fraudulent refunds, another $2.7bn in fraudulent claims stopped, around 56,000 alleged perpetrators and over 100 arrests to date. How did the TikTok tax scandal get out of control?

“Everyone else got refunds,…

What does it take to pass your business to the next generation?

What is the end game for your business? Succession is not just a topic for a TV series or billionaire families, it’s about successfully transitioning your business and maximising its capital value for you, the owners.

When it comes to…

Why is my tax refund so small this year?

The tax refund many Australians expect has dramatically reduced. We show you why.

There is a psychology to tax refunds that successive Governments have been reticent to tamper with. As a nation, Australia relies heavily on personal and…

Small land subdivision makes for big tax costs

You’ve got a block of land that’s perfect for a subdivision. The details have all been worked out with Council, the builders, and the bank. But, one important aspect has been left out; the tax implications.

Many small-scale developers…

Optimised Accounting is moving office

On the 14th of August 2023, we're moving to 89 Simcock Avenue, Spotswood!

We are thrilled to announce that our new office is strategically situated 7km from the CBD (and 300m from the Spotswood rail station) to be convenient for all our…

Rental Property Reporting Blitz

The Australian Taxation Office (ATO) has launched a full-on assault on rental property owners who incorrectly report income and expenses.

The ATO’s assessment, based on previous data matching programs, is that there is a tax gap of…

Tax obligations for online content creators

The explosion of OnlyFans, YouTubers, TikTokers and others all offer an opportunity for ‘content creators’ to profit from the audiences they generate. But now the Tax Office has given notice to the booming industry.

Back in October…

Inflation deflating your small business: 7 adjustment tips

Inflation is a term that we've all heard quite frequently lately, with rates rapidly increasing. Small businesses are particularly feeling the effects of inflation, with supplies costing more, employee shortages, and shrinking profits. In…

What do I do before EOFY?

EOFY is once again around the corner, and we encourage business owners to be proactive. Talk to your accountant, look at your books, and make any little adjustments needed before June 30 hits. This will have optimal results for next financial…

$3 million+ Super balance nest eggs will get their tax doubled

The Government has announced that from 2025‑26, the 15% concessional tax rate applied to future earnings for superannuation balances above $3 million will increase to 30%.

In a very quick turnaround from announcement to draft legislation,…

$20k Small Business Energy Incentive

In a pre-Budget announcement, the Government has committed to a Small Business Energy Incentive Scheme that offers a bonus tax deduction of up to $20,000.

The Small Business Energy Incentive encourages small and medium businesses with…

Super to be paid per paycheck and pursuable if owed

As announced in the 2023 May Budget, from 1 July 2026, employers will be required to pay their employees’ super guarantee entitlements on the same day that they pay salary and wages. Currently, super guarantee is paid quarterly. The Government…

Instant Asset Write Offs (IAWO) capped to $20k again

From 1 July 2023 until 30 June 2024, the Government will change the instant asset write-off threshold to $20,000.

Previously, 'small' businesses under a turnover of $500 million, could immediately deduct assets acquired from 6 October 2020…

Slower asset write offs, some tweaks & changes to tax, and more money for ATO compliance!

Last year we had a double deal of government budgets, and without even coming full circle yet, it's time for this year's budget.

https://vimeo.com/825343630

Businesses have limitations and compliance warnings to be aware of,…

Why your tax return will be $1500 worse this year

For the past couple of years, you may have gotten used to your tax either costing less than you remember, or your refund being more generous. More money for you to spend on necessities, or an extra treat for the holidays.

But that won't…

Risky trust distribution loopholes plugged

The ATO has released its final position on how it will apply some integrity rules dealing with trust distributions - changing the goal posts for trusts distributing to adult children, corporate beneficiaries, and entities with losses. As…

ChatGPT versus accountant: Showdown

It feels like AI truly are taking everything over. So, without exercising too much paranoia, we wanted to test the mettle of this latest innovation to take the world by storm, ChatGPT. Will it work with the Australian tax system, making…

What Work from Home deductions apply for me?

The Australian Taxation Office (ATO) has updated its approach to how you claim expenses for working from home.

The ATO has ‘refreshed’ the way you can claim deductions for the costs you incur when you work from home. From 1 July 2022…

FBT in 2023

2024 update: since these electric vehicle concessions were released, the ATO's been catching out business reporting incorrectly and hybrid electric vehicles have different rules. Head to our 2024 article for all the details.

Fringe benefits…

Making business moves with financial goals

Businesses tend to progress more consistently if the owner sets financial goals and makes a plan to achieve them. The new year is a natural time to decide what you want to achieve and how. With that in mind, read on to learn the steps for…

Secure Jobs, Better Pay reforms

The Government’s ‘Secure Jobs, Better Pay’ legislation passed Parliament on

2 December 2022. We explore the issues.

The Fair Work Legislation Amendment (Secure Jobs, Better Pay) Bill 2022 passed Parliament on 2 December 2020.…

Essential business de-cluttering for the new year

The end of the year tends to be a bit chaotic for business owners, but it's actually a good time to get some extra housekeeping done for your business. Read on for some tips to help you finish the year neatly and feel prepared to face the…

Extension to domestic violence leave

Employees in Australia will soon have access to paid family and domestic violence leave. Business owners and employers should be aware of these changes as the paid family and domestic violence leave means you will have to pay up to 10 days of…

Another 1% interest around the bend?

Low interest rates have been a mainstay since the global financial crisis of 2008. When the pandemic hit, Governments pushed stimulus measures through the economy and central banks reduced interest rates even further. Coming out of COVID,…

When “Hi, Mum, I broke my phone” costs you a fortune

I got a text the other day “Hi Mum, I have broken my phone and I am using this number.”

The “Hi Mum” scam has exploded with more than 1,150 Australians falling victim to the ploy in the first seven months of 2022, with total reported…

Errors to avoid when setting up Payroll

Upgrading or changing your payroll system comes with a ton of wonderful benefits. Saving time and money, making everyone’s lives easier, and better integration are all good reasons to consider a change. But if the switch is mishandled,…

2022 Budget wrap-up (October)

Thanks for all those who attended our webinar summarising the budget.

A recording is now available below:

For some more details read below:

There is nothing in this Budget that would create a UK style crisis.…

Queensland backs down on Australia wide land tax

The Queensland Government has backed away from an amendment that would have seen the land tax rate for investment property in Queensland assessed on the value of the investor’s Australia wide land holdings from 1 July 2023, not just the…

To cut or not to cut? Stage three personal tax cuts

In September, amid a climate of startling interest rates, UK Chancellor Kwasi Kwarteng announced a series of tax cuts, including the reduction of the top personal income tax rate that applies to those earning more than £150,000 from 45%…

Australian super funds gorge on cryptocurrency

The value of cryptocurrency assets inside Australian self managed superannuation funds (SMSFs) increased by 589.9% ($1.17bn) between June 2019 and June 2022, according to the latest ATO statistics.

While cryptocurrency is a relatively small…

An update on the 120% deduction for skills training and technology costs

You may remember us posting about the 120% skills training and technology costs deduction in May as it was announced. (for a recap on that post, find it here).

The Government has reinvigorated the 120% skills training and technology costs…

What are the differences between wages, salary, commission, and bonuses?

There are a few different methods that employers use to pay their employees, and while they may have similarities, they each also have their own implications for your business and its employees. On top of that, there may be a blended model…

Shaun talks about family trusts

Shaun Farrugia was invited back onto the podcast 'Financial Autonomy' recently, and the episode is now available to listen to.

Shaun and Paul Benson talked about family trusts for 40 minutes, and it's worth a listen!

They talked about…

Small Business Specialist Advice Pathways Program

We sent out an email about a new grant and we said that there were limited applications available. Well, it has been exhausted and they are now taking waitlists.

To quickly sum up:

The Victorian government announced a new $2000 grant for…

Do I need a .au domain name?

You may have already heard about the new domain extension about to launch in Australia, but don't dismiss this news as unimportant.

If you are a business owner, (especially if you have a .com.au domain name) this impacts you.

Failure to…

Can I claim my crypto losses?

The ATO has released updated information on claiming cryptocurrency losses and gains in your tax return.

The first point to understand is that gains and losses from crypto are only reported in your tax return when you dispose of it -…

Who can get the new electric car tax concession?

New legislation before Parliament, if enacted, will make zero or low emission vehicles FBT-free. We explore who can access the concession and how.

FBT free electric cars

Electric vehicles (EV) represent just under 2% of the new car market…

Should I keep my business in the family, or sell?

Planning for the succession of a business is an important and sometimes overlooked part of a business plan.

Once you exit the business you could keep your business in the family, sell to management or employees, be bought out by investors…

What is lifestyle planning?

When you think of financial planning, you probably imagine ways to increase your wealth, such as making a budget, reviewing what’s coming in and going out, and creating a plan for how to make the most of your money.

You may think of…

Why you should raise your prices

Running a business can be stressful, there's no question about that.

In the lead up to EOFY, we held tax planning sessions, new year goal discussions, and had a general catch up with most of our business owner clients. Apart from these…

How do I overcome my customers’ fear of spending?

One of the biggest complaints from salespeople in a tight economy is the time it takes to achieve a sale. So, what can you do to speed up the sales process?

Sell the solution not the product

Branding is wonderful but unless your brand…

Do you pay taxes when selling a house that’s your home?

Everyone knows you don’t pay taxes when selling a house in which you live…right? We take a closer look at the main residence exemption that excludes your home from capital gains tax and the triggers that reduce or exclude that exemption.

What…

How do I manage payroll effectively?

Payroll is one of those things that starts out simply enough. You start your business, hire a few employees, and things tick along pretty well. It’s straightforward enough to keep everything in line at first, but what happens to most companies…

What is the ATO looking for this tax time?

With tax season almost upon us the Australian Taxation Office (ATO) has revealed its four areas of focus this tax season.

Record-keeping

Work-related expenses

Rental property income and deductions, and

Capital gains from crypto…

What to expect from the new Government

Anthony Albanese has been sworn in as Australia’s 31st Prime Minister and a Government formed. We look at what we know so far about the policies of the new Government in an environment with plenty of problems and no easy fixes.

The economy

The…

EOFY Super deadline is approaching

We'd like to have your attention about superannuation payments prior to EOFY.

Although not necessary, you have the option of:

paying employee super one month early

topping up extra super into your own fund

Both will give you a…

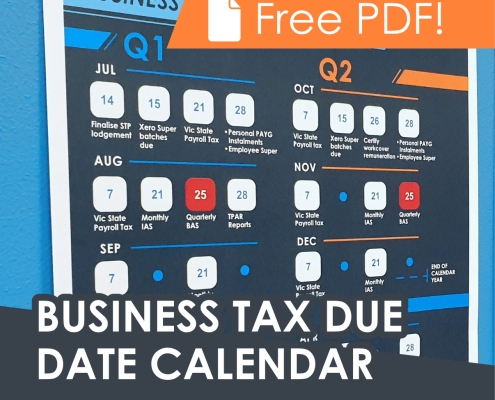

Keep up with your BAS due dates in 2023 with a Free Calendar!

Keeping up with all your business' BAS due dates gets complicated fast. PAYG, Payroll tax, BAS, superannuation... and dog's breakfast. Keep scrolling to untangle the chaos with our due date calendar, structured and clear so you know what to…

What is Audit Insurance?

As part of our products and services, we offer Audit Insurance to all of our clients (both business and individual).

We partner with Accountancy Insurance for this product as they seem to have the most well rounded and competitive policy.…