*edit* This update is from 2020.

If you are looking for our 2021 business due date calendar you will find it here.

Happy New Financial Year!

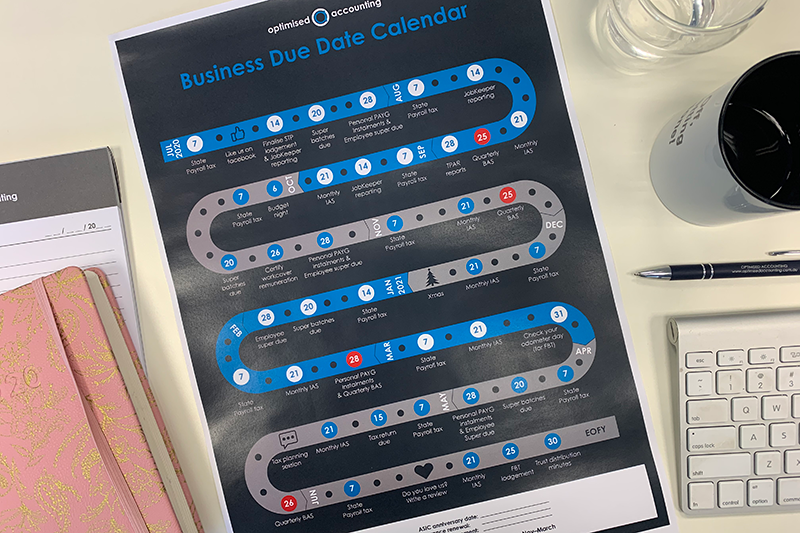

Updated posters available

On the back of the popularity of last years due date calendar, we have created a new one for this year.

We usually hand out these posters during pre-EOFY tax planning sessions, however this year these were done on Zoom.

There are lots of dates to remember for Australian business owners, so we have created this due date calendar so that you can have it front and mind throughout the year.

If you would like to get your hands on one of these posters, we will gladly send you one.

(Please note, this is an old calendar, and so the link to receive this has been removed)

BAS

Business Activity Statements are the due dates that can be the most confusing.

- September BAS due 28th October 2020 (extended until 25th November 2020 with a tax agent)

- December BAS due 28th February 2020 (everyone gets an extension on this one!)

- March BAS due April 28th 2021 (extended until 28th May 2021 with a tax agent)

- June BAS due 28th July 2021 (extended until 26th August 2021 with a tax agent)

Super

Employee Superannuation is also paid in quarters, and is very important that it’s on time.

- Due 28th July 2020 (Put through batches by 20th July 2020)

- Due 28th October 2020 (Put through batches by 20th October 2020)

- Due 28th January 2021 (Put through batches by 20th January 2021)

- Due 28th April 2021 (Put through batches by 20th April 2021)

Be emailed these due dates

Sign up to our monthly newsletter to receive due dates for that month, news, tax tips and other important things that we think are useful and interesting throughout the year.